How to Ensure Proper Bookkeeping as a Freelance Consultant

As a freelance consultant, you’re not just an expert in your field; you’re also a small business owner. This means that in addition to your esteemed skills, you also bear the responsibility of managing your finances, including bookkeeping and invoicing.

For many freelance consultants, this can be a daunting aspect of the job. But fear not, you don’t need to be an accountant to keep your finances in order. With a bit of organization and the right tools, you can set up a system that helps you manage your bookkeeping and invoicing efficiently and stress-free.

There are numerous reasons why maintaining accurate bookkeeping and invoicing is essential for freelance consultants:

By recording your income and expenses, you have a clear overview of your financial health. This allows you to make better financial decisions, such as setting your rates, budgeting for future expenses, and setting aside tax money.

Once you have a good system in place for tracking your income and expenses, filing your taxes becomes much easier. This can save you time and money, and it helps prevent mistakes that could lead to penalties.

If you ever need to apply for a loan or credit, lenders will ask for your financial statements. Well-maintained bookkeeping shows that you’re a responsible business owner and increases your chances of approval.

By analyzing your financial data, you can gain valuable insights into your business. You can see which services are most profitable, where your money is going, and where you can improve your efficiency.

Bookkeeping and invoicing for freelance consultants basically involves tracking your income, expenses, and invoices. Here are the steps you should follow:

Choosing the right bookkeeping system is the foundation for efficient financial management. Here’s a breakdown of the available options:

Manual Bookkeeping:

Spreadsheet Software:

Accounting Software:

Consider your budget, technical skills, and the complexity of your business when selecting software. Popular options for freelancers include:

Effective management of your freelance income begins with establishing clear financial boundaries. One essential step is to open a separate bank account exclusively dedicated to your freelance endeavors. This practice ensures that your business transactions remain distinct from your personal finances, streamlining your accounting process and minimizing confusion. By segregating your income in this manner, you not only enhance financial organization but also demonstrate a commitment to professionalism and fiscal responsibility.

In addition to maintaining a separate bank account, meticulous record-keeping is crucial for tracking your freelance income accurately. Each time you receive payment for your services, document pertinent details such as the date of payment, the amount received, the payment method used, and the client’s identity. This comprehensive record not only provides clarity regarding your earnings but also serves as valuable documentation for future reference. Furthermore, retaining all invoices and payment receipts ensures that you have tangible evidence of your financial transactions, which can be invaluable for tax purposes and financial planning. By adhering to these practices, you establish a solid foundation for managing your freelance income effectively and fostering long-term financial stability.

Keeping track of your expenses is vital for maintaining a healthy financial balance as a freelancer. Every business expenditure, regardless of its size, should be meticulously recorded. This encompasses various items such as office supplies, computer equipment, software subscriptions, marketing expenses, travel costs, and rent payments. By diligently documenting these expenditures, you gain insight into where your money is going and can make informed decisions to optimize your budget and maximize profitability.

Moreover, it’s essential to retain all receipts and invoices as evidence of your expenses. These documents serve as tangible proof of your financial transactions and are crucial for accurate record-keeping and tax compliance. Whether it’s a receipt from a stationery store or an invoice from a software provider, each piece of documentation contributes to the integrity and transparency of your financial records. By maintaining thorough documentation of your expenses, you not only demonstrate financial responsibility but also empower yourself with the information needed to effectively manage your finances and grow your freelance business.

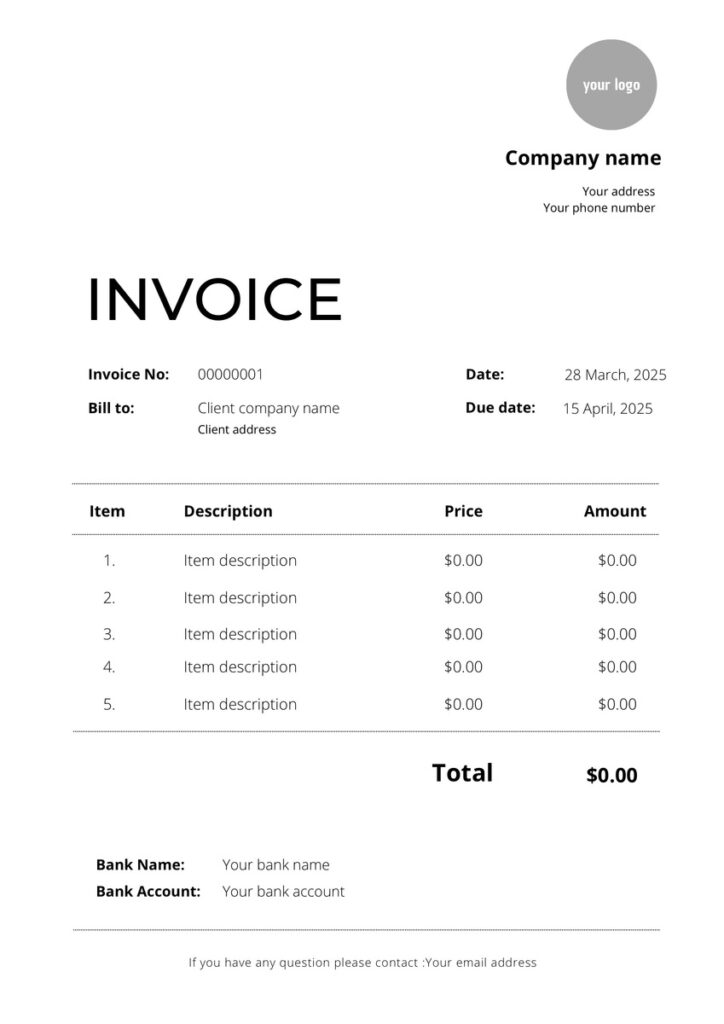

Once your project is successfully wrapped up, the next crucial step is sending an invoice to your client. An invoice serves as a formal request for payment and must include specific details to ensure clarity and prompt processing. Start by prominently featuring your business name and contact information at the top of the invoice, establishing your identity and providing a means for the client to reach out if needed. Similarly, include the client’s name and contact information to ensure the invoice reaches the correct recipient and facilitates communication regarding payment.

Next, incorporate essential elements such as a unique invoice number and the date of issuance. These details serve as reference points for both you and your client, aiding in tracking payments and maintaining organized records. Additionally, provide a comprehensive description of the services rendered, detailing the scope of work completed. Whether you opt to itemize each service or provide a summary, clarity is essential to avoid any misunderstandings regarding the billed services.

Clearly outline the rate per service or present a total amount due. This enables your client to understand the cost breakdown and facilitates timely payment. Finally, specify the payment terms, including the due date and acceptable payment methods, to set clear expectations and ensure a smooth transaction process.

For a visual example of a well-structured invoice, feel free to refer to the sample provided. Utilizing such a template can help ensure that your invoices meet industry standards and effectively communicate the details of your services and payment expectations.

Managing taxes is a critical responsibility for freelance consultants, distinguishing them from traditional employees. Being self-employed means taking charge of your tax obligations, necessitating a thorough understanding of relevant regulations. Familiarizing yourself with tax rules applicable to self-employed individuals in your country is paramount to ensure compliance and financial health.

To navigate tax obligations smoothly, it’s imperative to allocate funds regularly to cover taxes. By proactively budgeting for taxes throughout the year, freelancers can prevent unexpected financial strains during tax season. Additionally, staying informed about available tax deductions and credits is essential for optimizing tax situations and minimizing liabilities. Deductions may encompass various business-related expenses, such as office supplies, equipment, professional development, and travel.

Store all financial documents, such as invoices, receipts, bank statements, and tax returns, in a safe place. You can store them physically in a folder or digitally in the cloud.

It’s important to keep your records for at least 7 years, in case you need them for tax purposes or other administrative procedures.

Creating clear, professional invoices is crucial for freelance consultants. It not only ensures you get paid promptly but also establishes trust and professionalism with your clients.

An effective invoice clearly outlines the services rendered, associated fees, and payment terms. This transparency prevents misunderstandings and helps avoid potential disputes. Additionally, professional invoices showcase your attention to detail and commitment to high-quality service, further solidifying your reputation as a reliable business partner.